by Andrew Kidde

Climate change has arrived. In the northwest, climate problems are likely to worsen in the coming decades—increased wildfires, smoky and polluted air, heat waves, droughts, floods, etc. These crises will lead to economic disruption and fewer resources. Our poorer communities will be hit hardest. The rich already seek protection: anti-immigrant movements, police-state treatment of refugees and the homeless, and the ever more popular “gated communities” and “doomsday escape plans” for the super wealthy. Left unchecked, the trajectory of these trends in a world of worsening climate crisis will create a dystopian future.

As climate activists, we seek a different future where communities come together to make the changes we need to survive climate change. To do this, our state and local governments need to set a different course. Rather than implementing homeless sweeps, they should respond to the next crisis by saving lives, helping relocate and re-engage the displaced. Rather than permitting gated communities at the edges of suburbia, state and local governments should help communities become more inclusive, energy efficient, resilient, transit focused, and healthy.

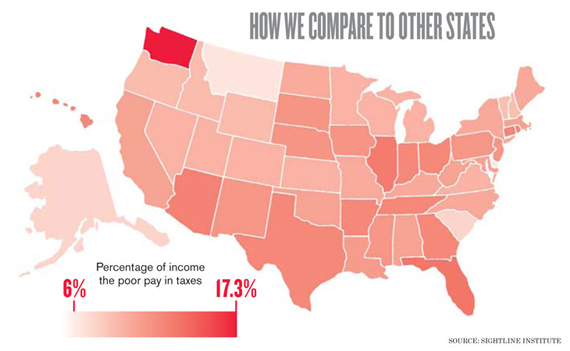

To pay for this, local and state governments need adequate revenue that is based on a fair tax system. We don’t have this now. A recent report found that in our current tax structure, “the poorest fifth of residents pay 17.8 percent, (while) the top 1 percent only pay about 3 percent of their income in taxes.” Our state and local tax system, considered the most regressive in the country, has long been unfair and dysfunctional. As the crises of climate change hit us, this will become dramatically worse—our poorest communities will both pay the highest state and local taxes, and face the brunt of damages from heat waves, floods, and poor air quality.

The good news: We can design a tax structure that collects revenue more fairly. In Oregon, for instance, the poorest families and the wealthiest families pay a relatively equal percentage of their income, about 9%, in state and local taxes. Climate activists should join the struggle to restructure our taxes. We can start by supporting Noel Frame’s bill, Modernize and Rebalance State Tax (HB2117 / SB 5973), which gained several sponsors in both houses last year. Other recent proposals include a state capital gains tax, a corporate tax on high earners, and of course Seattle’s Income tax ordinance, the constitutionality of which will soon be taken up by the State Supreme Court. It is hard to know at this point which proposals will gain momentum down in Olympia. For now, let’s be sure to tell our legislators that it is time to make our tax system more equitable and more appropriate for the coming climate challenges we face.